30+ Home line of credit calculator

Monthly interest payment 000041 300 30 369. Interest rate APR The annual percentage rate for this line of credit.

Walmart Pay Stub Template Samples Of Paystubs Nurul Amal In 2022 Payroll Template Statement Template Professional Templates

Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more.

. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. Before you ask for a Credit One Bank credit line increase you should make sure that your credit score is in good standing. Let Bankrate a leader.

There is no specific formula to determine the monthly amount. Interest rate 1 as a percentage Minimum interest rate. As the Federal Reserve has lifted short-term interest rates in the late 2010s many homeowners who typically opted for the cash-out refi option in the prior decade became more inclined to use a home equity loan or line so they keep their existing low rate on the majority of their home debt.

How you use credit affects your credit score. Use too much and your score goes down. Use too much and your score goes down.

Be sure to understand the fees and costs pertaining to loans. The Annual Percentage Rate APR is variable and is based upon an index plus a margin. Enter an amount between 0 and 30.

Earn unlimited 2X miles on every purchase every day. Taking out a line of credit on your home refinancing your home or seeking out personal loans are good alternatives. Once you know your homes value and your current mortgage balance try a home equity loan calculator to start your home equity loan search.

Choose the term usually 30 years but maybe 20 15 or 10 and our calculator adjusts the repayment schedule. Your credit report card shows your ratio credit card debt credit limit and how different factors affect your score. 5 year fixed mortgage rates.

Line of credit calculator. Get your debt usage now. Fortunately there are plenty of ways to check your credit score online.

A home equity line of credit or HELOC is a type of home equity loan that works like a credit card. You would then get a HELOC in place and your rate would be around Prime030 which at the time this article was published is 500. How you use credit affects your credit score.

Resist funding short-term needs with what may eventually amount to a long-term loan. Line of credit calculator. 5 year variable mortgage rates.

For example if your lender will allow a 95 ratio the calculator can draw that line for you in addition to the other three. One risk to avoid whether you choose a home equity line of credit or a loan. Lopatin also warns that a line of credit can be an addictive source of funds with homeowners accessing the line of credit even for trivial matters.

Enjoy a one-time bonus of 75000 miles once you spend 4000 on purchases within 3 months from account opening equal to 750 in travel. Its a good idea to use no more than 30 percent of your available credit with an ideal utilization ratio of under 10 percent. In this way a home equity loan might be the better option as it provides for a specified amount to be repaid over a fixed term.

The lender or the credit institution can determine the payment size that shall depend upon factors such as the outstanding balance the interest rate and the terms of the line of credit Line Of Credit A line of credit is an agreement between a customer and a bank allowing the customer a ceiling limit of borrowing. It can also display one additional line based on any value you wish to enter. Finally in the Interest rate box enter the rate you expect to pay.

For Texas primary residences we will lend up to 80 of the total equity in your home and your line of credit amount cannot exceed 80 of the homes value. Then as the COVID-19 crisis struck interest rates crashed to the floor shifting homeowner. Line of credit calculator.

The calculator does the math for you and gives you a rough idea of whether the full application is worth the effort. It essentially functions as a credit card secured by. Home Equity Line Of Credit HELOC Calculator.

Your credit utilization ratio or how much of your credit limit you use makes up 30 of your credit score. Your credit utilization ratio or how much of your credit limit you use makes up 30 of your credit score. Free credit card calculator to find the time it will take to pay off a balance or the amount necessary to pay it off within a certain time frame.

All home equity calculators. How much house can you afford. A home equity loan or home equity line of credit HELOC allow you to borrow against your ownership stake in your home.

All home equity calculators. Home Equity Line of Credit. You can do this with our Home Equity Line Of Credit Calculator.

Use our Personal Loan Calculator to estimate the real APR of the loan which should be at least a few points lower than the credit card interest rate for this. After this you should select the lender that offers the best rates for you having gone through proposals from as many lenders as possible. Try a home equity loan calculator before you apply.

A home equity line of credit is a line of credit secured by your property. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within. The APR will vary with Prime Rate the index as published in the Wall Street Journal.

All home equity calculators. A home equity line of credit HELOC is a type of loan that allows you to borrow and repay money as you need it over a certain period of time. The Brex 30 card offers 8X points on rideshares and also comes with no annual fee.

Your credit report card shows your ratio credit card debt credit limit and how different factors affect your score. Youre given a line of credit thats available for a set time frame usually up to 10 years. The interest rates are competitive with other types of loans and the terms.

Get your debt usage now. Which is a method of combining all debt under a new line of credit can offer temporary relief. Calculate your mortgage payment.

If you use your home or other assets to secure your loan or line of credit youll get more credit likely a lower interest rate and repayment options that work for you. He suggests no more than 20000. For line amounts greater than 500000 maximum combined loan-to-value ratios are lower and certain restrictions apply.

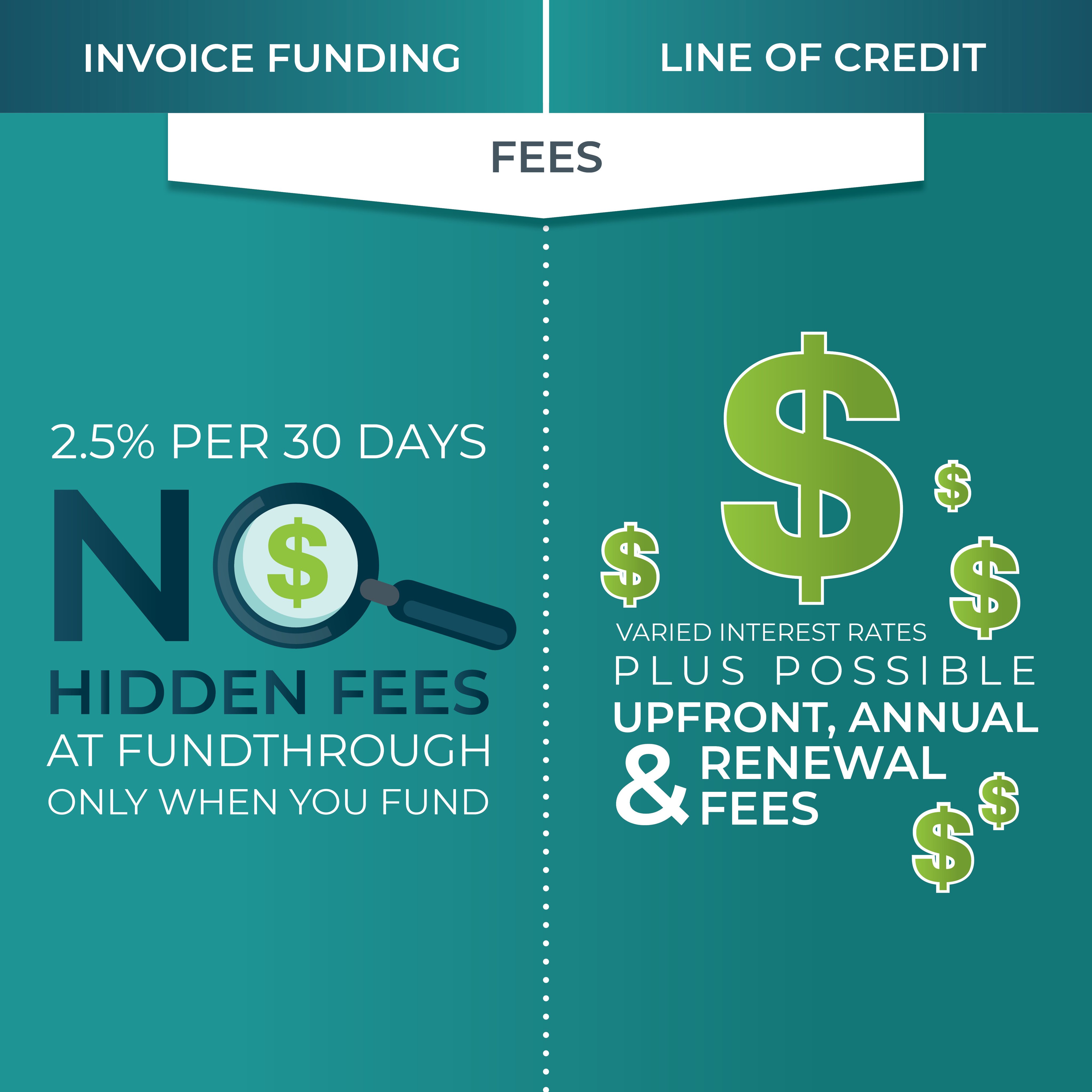

Fundthrough Fundthrough Twitter

Pin On Bussines Template Graphic Design

4 Bonus Structure Templates Free Sample Templates How To Plan Bonus Templates

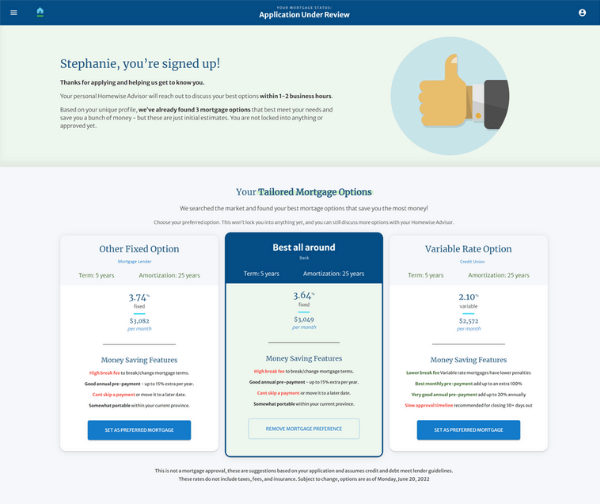

Homewise Review Loans Canada

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

Holiday Budget Calculator Excel Basic Budget Template How To Make Basic Budget Template For Personal Nee Excel Budget Template Excel Budget Budget Template

Are You Looking For Step By Step Instructions On How To Create A Budget When You Are Behind On Bills Here The Steps Budgeting Money Management Budget Planning

Pin On Bussines Template Graphic Design

Net 30 And Other Invoice Payment Terms Invoiceberry Blog

30 Questionnaire Templates And Designs In Microsoft Word Inside Business Requirements Questionnaire Templ Questionnaire Template Questionnaire Survey Template

Upshift Preview Travel Planner Mobile Design Inspiration Planner Dashboard

Borrow Loan Company Responsive Website Templates Loan Company Wordpress Theme Responsive The Borrowers

Live Trading Smc Strategy On Eurusd In 2022 Money Management Stock Trading Cryptocurrency

Pin On Dashboard

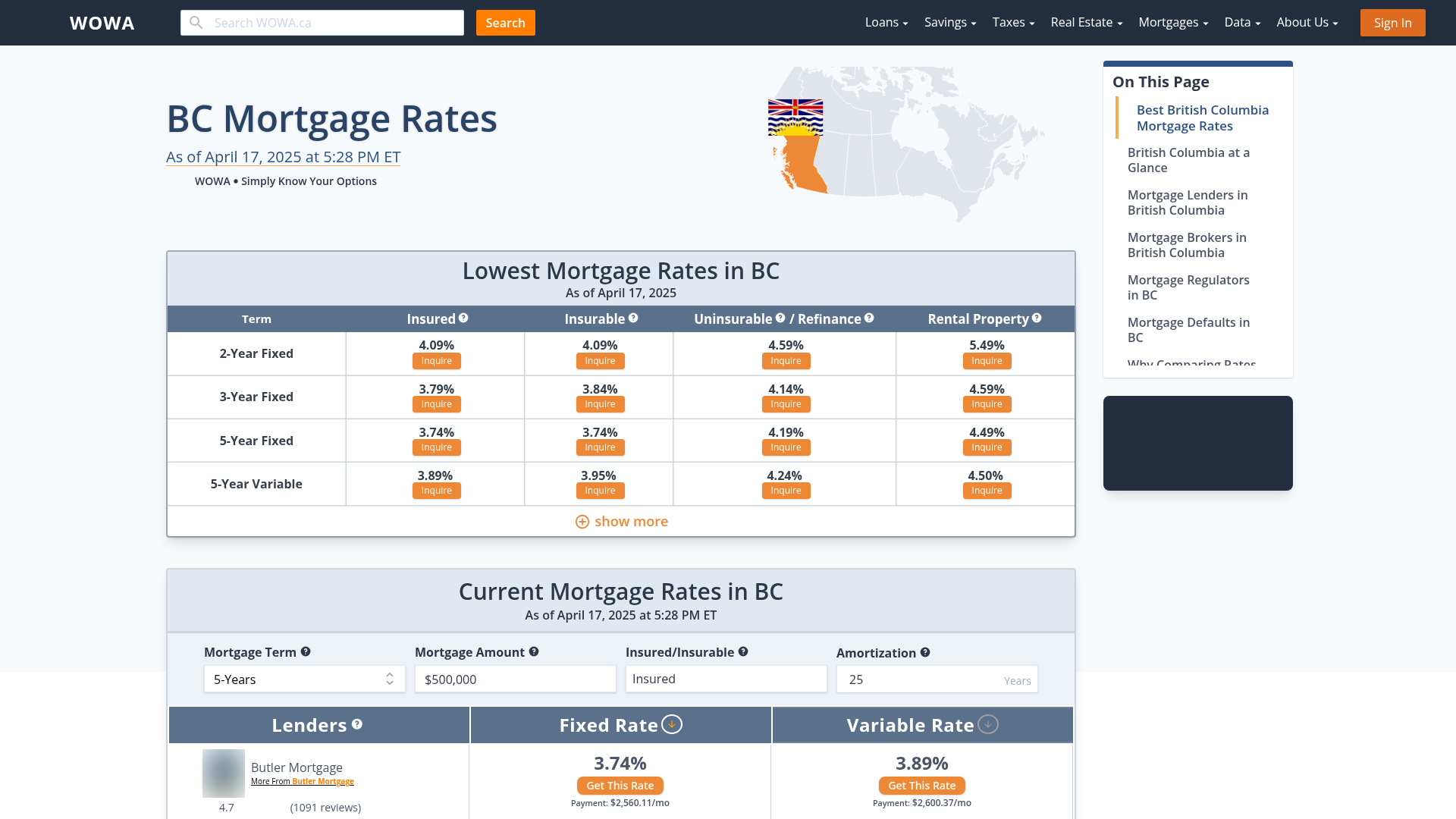

British Columbia Mortgage Rates From 30 Bc Lenders Wowa Ca

Event Budget Template Event Budget Template Event Budget Budget Spreadsheet